gambling income tax calculator

The state tax rate in Michigan is 425 which is the rate your gambling winnings are taxed. Illinois is one of nine states with a flat tax on all income in this case 495.

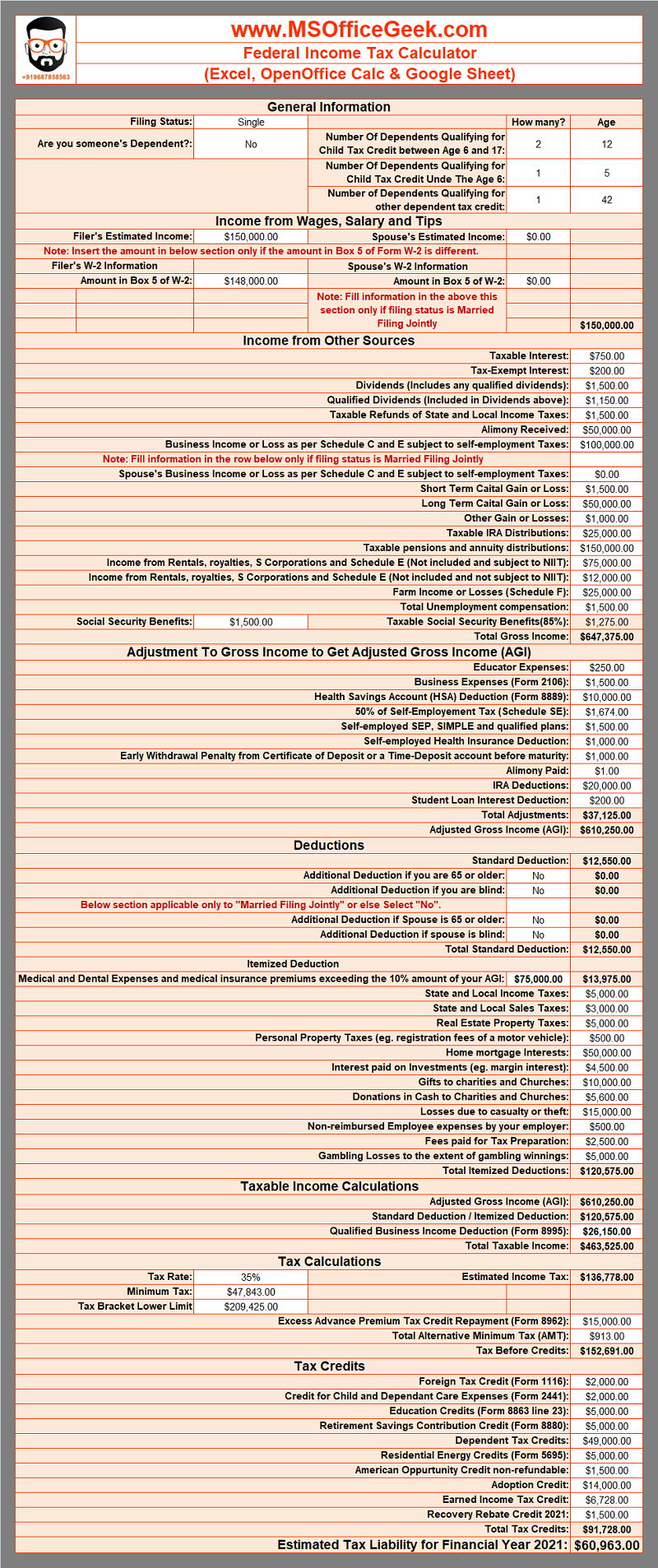

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

This review is not the result of an audit.

. Illinois Gambling Tax Calculator. Get Your Max Refund Today. West was sentenced to 37 months in prison and ordered to pay 582934 the amount of taxes he owed in restitution to the Internal Revenue Service.

This amount is cumulative over the course of the year. But it doesnt take much an annual income of more than 17000 for the highest percentage to kick in. We received your 2003 Form IL-1040-X Amended Individual Income Tax Return dated December 1 2008 which you filed to amend your 2003 Form IL-1040 Individual Income Tax Return.

The Federal income tax brackets are from 10 to 37 for the year 2021. The taxes on winning calculator shows the state tax that Colorado charges on winnings of up to 50 free spins in certain games and it is remitted two days after qualifying. If you didnt give the payer your tax ID number the withholding rate is also 24.

For tax purposes however its the same as any other form. Just like other gambling winnings lottery prizes are taxable income. After gross income less standard deduction that is.

The following rules apply to casual gamblers who arent in the trade or business of gambling. Indiana allows different types of gambling including horse racing lottery sports betting slots and table gamesIt requires you to pay betting tax on cash. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Select your state on the calculator below select your relationship status add in your taxable income enter the amount you won and press calculate. Import Your Tax Forms And File For Your Max Refund Today. Filers with tax years ending on or after July 1 2017 - Public Act 100-0022 increased the income tax rate during your tax year.

Virginias state tax rates range from 2 to 575. This calculator is not appropriate for individuals who are aged 65 years or more have dividend or capital gains income rental property income self-employment income farming income who receive Social Security benefits or. But even winners can turn to losers if they dont declare and pay taxes on gambling winnings.

Maryland Gambling Tax Calculator. There is a 15 tax rate if you earn 600 or more betting on sports in Illinois. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Tax rates depend on your annual income and tax bracket. For non-resident aliens the current withholding tax is 30 federal and 6 state. Thats the percentage youd owe in state income tax for all gambling winnings which are considered part of personal income.

Tax calculator assumed a standard deduction of 12400 single. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state.

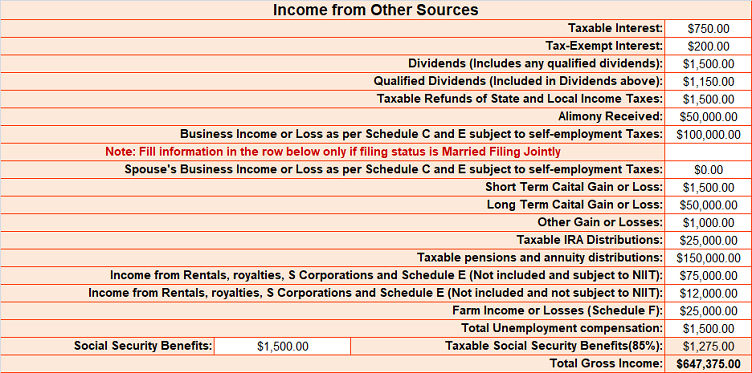

Gambling winnings are fully taxable and you must report the income on your tax return. Any winnings subject to a federal income-tax withholding requirement. Both cash and the value of prizes are considered other income on your Form 1040If you score big you might even receive a Form W-2G reporting your winnings.

Estimate your 2021 Tax Return for free now and include your gambling income or losses. Gambling income is subject to state and federal taxes but not FICA taxes and the rate will depend on your total taxable income not just wages minus deductions standard or itemized in Maryland. This includes cash and the fair market value of any item you win.

Gambling income includes but isnt limited to winnings from lotteries raffles horse races and casinos. When gambling winnings are combined with your annual income it could move you into a higher tax bracket so its important to be aware of. 419 Gambling Income and Losses.

Marginal tax rate is the bracket your income falls into. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket.

Tax Calculator Gambling Winnings. This calculator computes only an estimate of the income tax on gambing winnings for individuals with fairly straightforward tax situations. The tax code requires institutions that offer gambling to issue Forms W-2G if you win.

600 or more on a horse race if the win pays at least 300 times the wager amount. Online and retail sports betting is the newest form of gambling in Illinois. You will pay gambling tax as you file income taxes.

Its calculations provide accurate and reliable results that account for casino tax rates. Get A Jumpstart On Your Taxes. The standard deduction is 12550 single and 25100 married filing jointly for the year 2021.

Your household income location filing status and number of personal exemptions. We denied your claim for refund of overpayment of income tax. For six other years between 2004 and 2011 he failed to file any individual income tax returns despite gross receipts and gambling income over all eight years totaling 3190741.

The operator will use a gambling winnings calculator to determine the amount of tax you will pay after winning a big jackpot. We have completed our review. The state tax rate ranges from 4 to 882 depending on your New York taxable income.

Effective rate is the actual percentage you pay after deductions. This will display 2 figures the tax paid on your gambling winnings and the amount you can keep from your gambling winnings. In Arizona the Lottery is required by law to withhold 24 for federal taxes and 48 for state income taxes for United States citizens or resident aliens.

However precise information on the payouts earned must be provided. If a filer lives in New. Illinois taxes on sports betting winnings.

See Specific Instructions Schedule SA Instructions IL-1120 and Informational. Our income tax calculator calculates your federal state and local taxes based on several key inputs. When it comes to gambling be it online or in a casino there will always be winners and losers.

You must use Schedule SA IL-1120 or the blended income tax rate to calculate your tax if your tax year ends on or after July 1 2017. Take home pay calculator Chicago. Marginal tax rate is your income tax bracket.

Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts. More than 5000 in winnings reduced by the wager or buy-in from a poker tournament. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Tax Payment On Sports Betting Winnings Icen Nigeria

Gambling Winnings Tax H R Block

Crypto Gambling How It S Taxed Koinly

Tax Calculator Gambling Winnings Free To Use All States

Income Tax Calculator Officebabu Com

How Income Tax Calculator Makes It Easier To Choose Between New Old Tax Regimes Geeks And Cleats

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Filing Out Of State W 2g Form H R Block

Video How To Calculate Income Tax In Fy 2021 22 On Salary Examples New Slab Rates Rebate Fincalc Blog

Income Tax Calculator 2021 2022 Estimate Return Refund

Gambling Taxes How Does It Work And How Much Does It Cost

Tax Calculator Gambling Winnings Free To Use All States

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Income Tax Calculator Segregating Income In These 5 Heads Can Simplify Itr Filing Mint

Free Gambling Winnings Tax Calculator All 50 Us States

Colorado Gambling Tax Calculator Paying Tax On Winnings

Capital Gains Tax Spreadsheet Australia Budget Spreadsheet Excel Spreadsheets Templates Capital Gains Tax